Unreimbursed Employee Expenses 2024

Unreimbursed Employee Expenses 2024 – Your state will determine your ability to write off home-office expenses. Alabama, Arkansas, California, Hawaii, Minnesota, New York, and Pennsylvania provide a deduction for unreimbursed employee . Voluntary deductions: The amounts the employee opts to pay for employer-sponsored This means the 2% rule does not apply at least through 2025. Miscellaneous expenses included: Unreimbursed job .

Unreimbursed Employee Expenses 2024

Source : www.linkedin.comMark R. Stanhope CPA PC | Hudson MA

Source : m.facebook.comDr.Inc. (@DrInc9) / X

Source : twitter.comSIA Group | Jacksonville NC

Source : www.facebook.comStandard Business Mileage Rate Going up Slightly in 2024

Source : accountants.sva.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comEmployees’ Guide to Travel Expenses See The IRS Rules For 2024

Source : www.driversnote.com2024 IRS Mileage Rate Increases PPL CPA

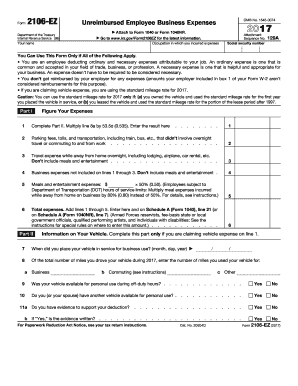

Source : www.pplcpa.comIRS 2106 EZ 2017 2024 Fill out Tax Template Online

Source : www.uslegalforms.comElection 2024 Tax Plans: Details & Analysis | Tax Foundation

Source : taxfoundation.orgUnreimbursed Employee Expenses 2024 🚗💨 IRS announces 2024 Standard Mileage Rates! 📈💼 | SIA Group : Claims for delayed payment of wages, unpaid overtime and minimum wages, unreimbursed business expenses, and failure to provide meal and rest periods have been brought as class actions representing all . Discover how self-employed individuals and employees can claim cellphone expenses as a tax deduction, and how the rules have changed over the years. .

]]>